The evolving landscape of investing is now looking for smarter ways to make investment decisions- hence the need for robo-advisors is witnessing a boost. A robo-advisor, as the name suggests, is designed using several sets of algorithms to reduce or eliminate human intervention from the investment process. These advisors are used for tax calculations, stock monitoring, portfolio management, and more.

A Grand View Research report suggests the size of the robo-advisory market is expected to grow at a CAGR of 29.7% between 2022 to 2030. Additionally, a Statista report also throws some light on the exponentially growing strength of robo-advisor users. The report says that by 2027, the number of users using robo-advisors will touch 234 million.

What is a Robo-advisor?

Robo-advisors (also known as robo-investing platforms) are digital platforms that are trained using massive amounts of algorithms. Users use robo-advisors to make wiser investments. These data-driven advisors eliminate the impact of human emotions and make decisions solely based on trends, predictions, and historical records.

How do Robo-advisors Work?

Robo-investing platforms begin working as soon as users onboard the platform. For starters, these platforms ask users a few questions to understand their current financial situation and financial goals.

A robo-advisor can ask users for bank and credit card transaction history, investment details, saving plans, and other such financial information to plan users’ investments accordingly.

Robo-advisors invest on the basis of users’ risk tolerance capabilities, investment behavior, preferences, and amount. The goal of the best robo-advisors is to eliminate risky investments as much as possible and safeguard the money being invested.

Once robo-advisors have the required data, their artificial intelligence algorithms and predictive analytics capabilities get to work. The quality of algorithms, however, might vary depending on how much data has been fed to these systems and how fast servers are getting updated.

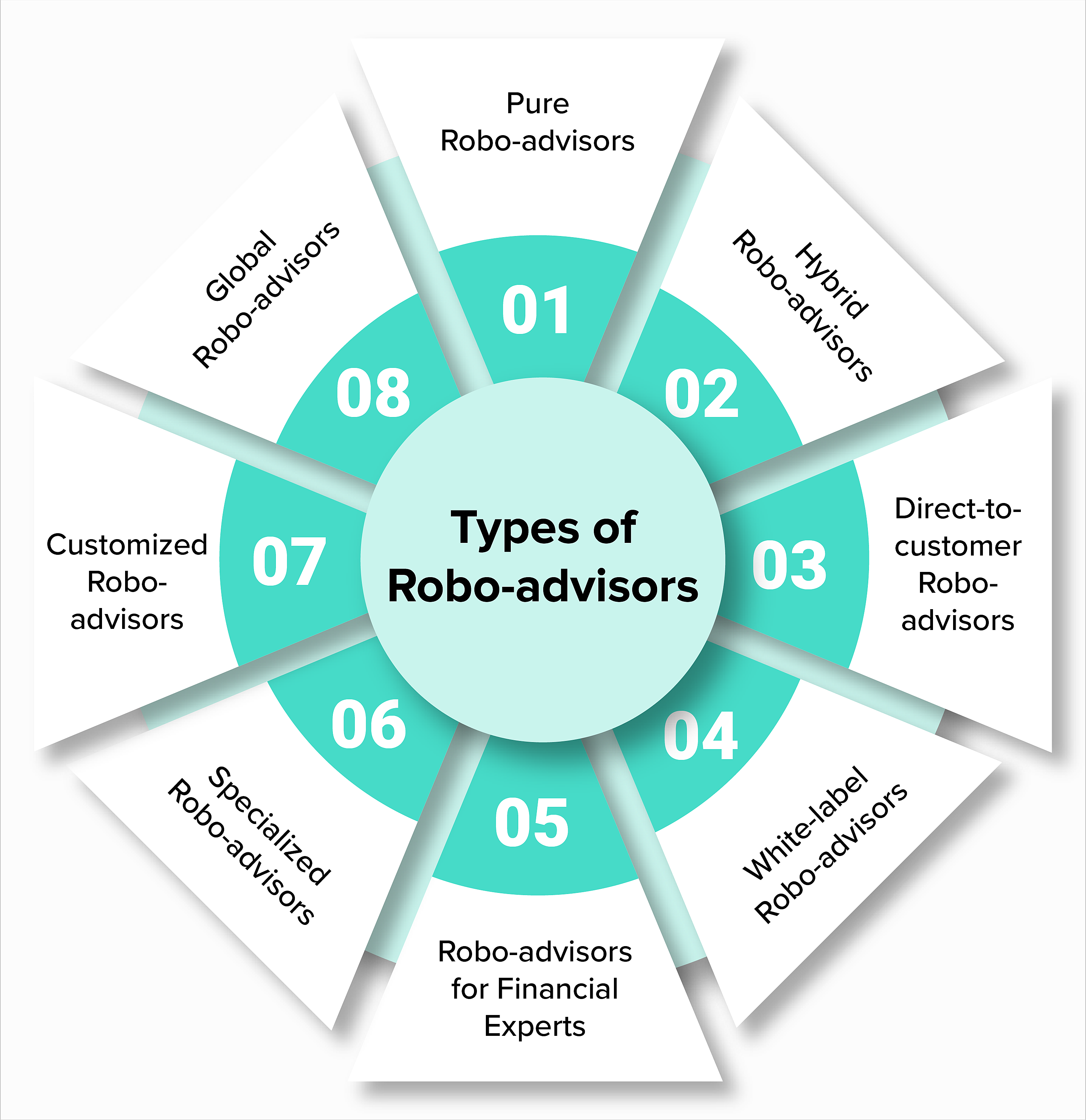

Types of Robo-advisors that Dominate the Market

Types of Robo-advisors

Robo-advisors are segregated into several categories depending on their characteristics. However, these categories evolve as the requirements of the market evolve. At the time of writing this blog, these are some categories that require your attention!

1. Pure Robo-advisors

The name itself hides the primary characteristics of robo-advisors from this category. Pure robo-advisors are fully automated and use massive amounts of data to make investment decisions. These categories of robo-advisors are the best for a headache-free investment approach. One can simply set requirements and let the robo-advisor do the rest of the work.

2. Hybrid Robo-advisors

These robo-advisors are equipped with the characteristics of automation and manual work. The platforms are equipped with algorithms to automate the investment strategy, however, there are human experts as well involved in investment recommendations. This makes hybrid robo-advisors a more comprehensive and practical solution for dynamic markets.

3. Direct-to-customer Robo-advisors

These platforms are directly accessible to retail investors. Consumers can directly register and invest using direct-to-customer (D2C) robo-advisors. D2C platforms are more affordable and are designed to minimize human interaction. Additionally, these platforms can automate resource allocation to reduce risks of possible losses as well.

4. White-label Robo-advisors

White-label robo-advisors are built by fintech companies for other financial institutions such as banks, financial advisors, or wealth management companies among others. This eliminates the need for clients to build their own software from the ground up to assist target customers.

These robo-investing platforms can be customized to meet the requirements and business models of client organizations. Developers can integrate White-label robo-advisors even in existing client software depending on the project and compatibility.

5. Robo-advisors for Financial Experts

The involvement of financial advisors makes these best robo-advisors quite trustworthy in the industry. Developers build these advisors for financial experts, who then, on behalf of their customers, automate financial tasks and manage portfolios with better efficiency.

6. Robo-advisors for Retirement Accounts

These AI-based financial platforms are specifically designed to help users set and secure their post-retirement goals. Robo-advisors are useful for managing IRA and 401(k) accounts as well. Robo trading platforms of such nature have a limited target market and often deal in less risky investments.

7. Specialized Robo-advisors

These robots are designed to target specific requirements, niches, or themes. One could pick healthcare investments as the preference and build specialized robo-advisors around it. Some themes that specialized robo-advisors can be built for are healthcare, real estate, income-focused, gold, art, and more.

8. Customizable Robo-advisors

As the name suggests, customizable robo-advisors are designed to give users full control over their investments. Users of customizable advisors can pick specific stocks to invest in, ETFs, and more.

A customizable investment platform can be the best robo-advisor for beginners as well as it provides them the opportunity to test their investment skills. Additionally, there are several research tools and market insights that these robo-advisors offer to help users make wiser investment decisions.

9. Global Robo-advisors

Global robo-advisors are designed to help investors target international portfolios. These advisors are functional beyond the borders of countries and can be useful for greater profits. These robotic advisors are great for a diverse investment portfolio.

Additionally, users can invest on these platforms using more than one currency. A global investment portfolio also provides the opportunity to reduce or recover losses by diversifying the portfolio.

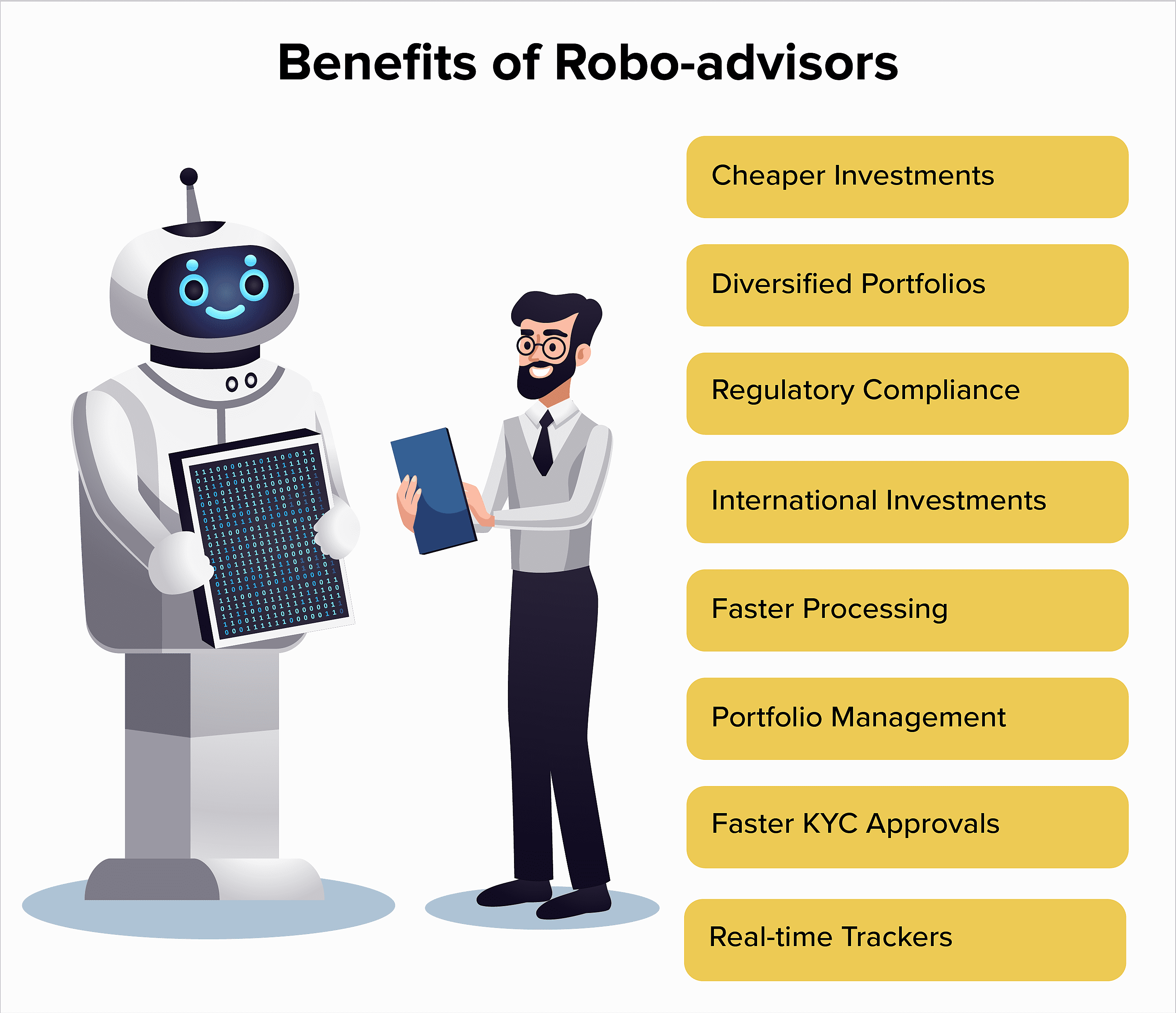

Advantages of Using Robo-advisors

Robo-advisors are designed to ease down the user journey. These platforms are equipped with advantages that focus on reducing investment risks, reducing investment costs, and boosting profits. Here are some of the advantages of robo-advisor investment strategies.

- Cheaper Investments - Reduction or elimination of human advisors from the process reduces the fees charged on investments. This helps fintech development companies onboard more customers while users get to save more money.

- Diversified Portfolios - Robo-advisors are able to help investors build diversified portfolios by using massive amounts of insights and predictive capabilities of algorithms. By taking ETFs, index funds, and other types of investments in accounts, robo-advisors can help users build safer investment portfolios as well.

- Regulatory Compliance - Robo-advisors are supposed to adhere to the regulatory requirements of their target markets. This makes it easier to find and trust the best robo-advisors active in the market.

- International Investments - Robo-advisors are expanding their target markets beyond the borders of countries. Additionally, with the support of more and more currencies for investments, it has become easier to make more diversified investments. International robo-advisors also help investors find more beneficial investments even if they are not in the same country.

- Faster Processing - Robo-advisors process investments faster due to their characteristics like automation. Additionally, their capabilities to comply with regulations, automate portfolio management, predict risks, etc. help robo-advisors make financial decisions faster while minimizing losses in parallel.

- Portfolio Management - Robo-advisors are smart enough to entirely automate portfolio management. This gives users the ability to focus on other important tasks. Automated portfolio management can be set up based on goals. For example, retirement plans, investment goals, asset purchases, etc.

- Faster KYC Approvals - Robo-advisors are often equipped with the necessary algorithms to scan and approve customers’ KYCs faster. These investment tools can cross-check verifications of identity documents much faster and more accurately than traditional methods. This makes it easier and faster to onboard robo-advisor platforms and open accounts.

- Real-time Trackers - Using robo-advisors, users can keep track of their portfolio’s value in real time. Using these trackers, users can stay in the loop with the dynamic stock market and keep their favorite stocks tracked for any manual investment decisions.

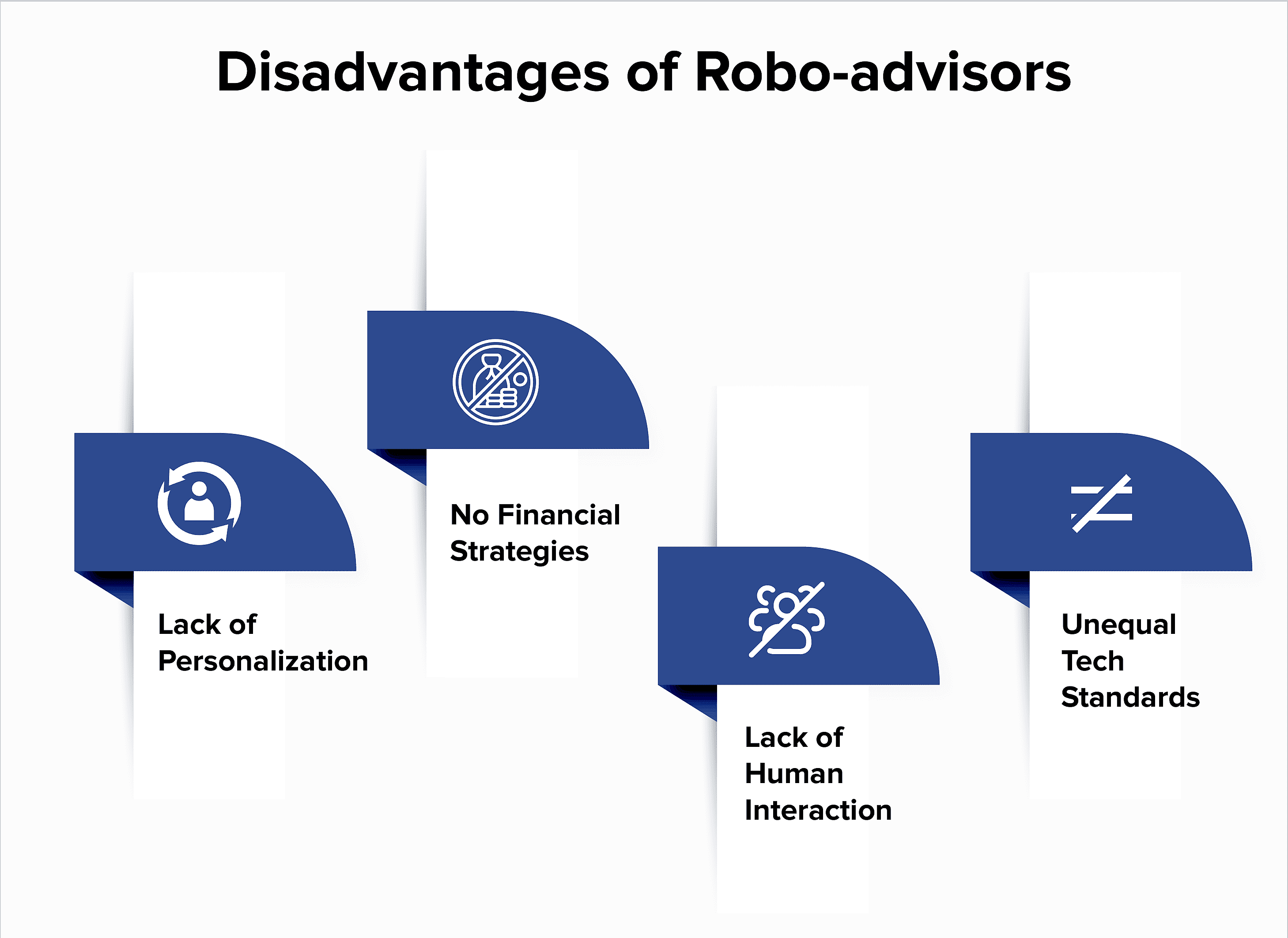

Disadvantages of Robo-advisors

Robo-advisors are still evolving and as more and more data gets generated, these advisors get smarter. However, there are a few limitations that might create a gap between the user and the best robo-advisors out there. Let’s have a look!

- Lack of Personalization - Robo-advisors make investment decisions on the basis of their algorithms which eventually limits the personalization of investments on automation. This personalization could be dependent on one’s financial capabilities, risk tolerance, and other factors.

- No Financial Strategies - Robo-advisors might give users financial advice but building a collaborative relationship to form effective strategies is something that is lacking here. These advisors deliver financial insights that investors can consider to approve their investments.

- Lack of Human Interaction - Robo-advisors eliminate the opportunity to have a human financial advisor. This sometimes leads to unsatisfied resolutions of queries by interested investors.

- Unequal Tech Standards - The ability of robo-advisors differs on the basis of how good the tech standards to build them are. These tech standards could refer to the amount of data used, the tech used, and more.

Best Robo-advisors for Smarter Portfolio Management

The market of robo-advisors is grand with hundreds of options in countries like the US, the UK, China, Germany, and more. This makes it difficult for potential users to find the best options that could assist them with their finances.

A few popular examples of pure robo-investing platforms are:

1. Wealthfront

Wealthfront stands tall among the best robo-advisors out there due to its ability to deliver a seamless automated investment experience. When users onboard the platform, it asks a few questions to know their investment preferences better. Wealthfront supports investments from as little as $500.

2. Betterment

Betterment is one of the earliest adopters of robo-advisors. The platform makes it as easy as possible to automate investments. At the time of writing this blog, the platform has over 800,000 users and a history of managing over $36 billion. Betterment can also help users automate their savings to achieve certain goals which can be a dream vacation, bike, or anything else.

3. SoFi

SoFi has a great reputation among the best free robo-advisors out there due to its ability to reduce users’ efforts effectively. The platform offers features such as auto rebalancing, goal planning, and diversification among others. Users can plan their investment goals whether they want to make enough money for a wedding, buy a dream car, or more. The robo-advisor is smart enough to guide you through it all.

4. M1 Finance

This dynamic platform has grabbed a massive fintech market and offers a range of features. The platform delivers a perfect automated tool for passive investing. Users have the ability to customize their investments and pick from over 6,000 stocks plus ETFs on the platform. On top of that, there is no commission, trading fee, or management fee charged by M1 Finance.

5. Stash

This robo-advisor tops the chart when it comes to delivering standard automated investing services. Stash offers smart portfolios to help users make better returns. Users can even get expert help on the platform if they are interested in some crypto exposure as well. Stash has personalized investing advice, automated recurring investing, and dividend reinvestments among other advantages.

Read the full Stash review here.

Wrapping Up

The market of robo-advisors is evolving, especially when users are getting more financially literate. Users prefer robo-advisors to make wiser investment decisions and secure financial securities.

Looking at their advantages, robo-advisors are surely the future of the investment market. Due to the rising standards of lifestyles and their ability to deliver financial securities, robo-advisors are helping users feel financially safer.

A Statista report predicts that the average assets under management per user on robo-advisors will amount to $8.05k in 2023.

Now apart from being great for retail investors, robo-advisors are also great for organizations. Companies are using these platforms to collect more accurate user behavior data and provide faster financial services. It gives them a better understanding of the market as well.

Frequently Asked Questions

-

Are robo-advisors worth it?

-

Can You Lose Money With Robo-Advisors?

-

Do robo-advisors make money?

-

How risky are robo-advisors?

-

Is a robo-advisor a good investment?

-

Is a robo-advisor good for beginners?

-

What Does a Robo-Advisor Do?

-

What is a robo-advisor and how do they work?

-

What is the disadvantage of using a robo-advisor?

-

Why would I use a robo-advisor?

Sr. Content Strategist

Meet Manish Chandra Srivastava, the Strategic Content Architect & Marketing Guru who turns brands into legends. Armed with a Masters in Mass Communication (2015-17), Manish has dazzled giants like Collegedunia, Embibe, and Archies. His work is spotlighted on Hackernoon, Gamasutra, and Elearning Industry.

Beyond the writer’s block, Manish is often found distracted by movies, video games, AI, and other such nerdy stuff. But the point remains, If you need your brand to shine, Manish is who you need.